The Importance of Life Insurance for UK Residents

Life is a journey filled with unpredictable twists and turns. While we cherish the good times, it's essential to prepare for the unexpected and secure the future of our loved ones. That's where life insurance comes into play. If you're a UK resident, understanding the significance of life insurance can be a game-changer for your financial planning and peace of mind. In this blog post, we'll explore why life insurance is so crucial for UK residents, ensuring you're well-informed and ready to make a wise decision.

Life Insurance: More Than Just a Policy

Before we dive into the importance of life insurance, let's clarify what life insurance entails. At its core, life insurance is a contract between you and an insurance provider. In exchange for regular premiums, the insurer promises to provide a lump sum payment (the death benefit) to your beneficiaries upon your passing. Here's why it's not just another policy:

Financial Security for Loved Ones:

Life insurance ensures that your family has the financial support they need if you were to pass away unexpectedly. It can help cover living expenses, mortgages, debts, and future financial goals.

Legacy Preservation:

Beyond financial support, life insurance allows you to leave a legacy for your loved ones. You can designate beneficiaries who will receive the benefits tax-free, offering them a secure financial future.

Peace of Mind:

Knowing that you've protected your family's financial well-being in your absence provides peace of mind. It's a safety net for life's uncertainties.

Explore why life insurance is especially important for UK residents:

1. Mortgage Protection:

In the UK, many families have mortgages to finance their homes. If you're the primary breadwinner, your passing could leave your family struggling to make mortgage payments. Life insurance can ensure that your loved ones can keep the family home by paying off the mortgage.

2. Education Expenses:

The cost of education is on the rise in the UK. Life insurance can help cover the expenses of your children's education, ensuring that they have access to quality schooling and higher education even if you're not there to provide for it.

3. Debt Relief:

Whether it's credit card debt, personal loans, or other financial obligations, life insurance can help settle your debts, preventing them from becoming a burden on your family.

4. Income Replacement:

Your income supports your family's day-to-day living expenses. Life insurance can replace your income, allowing your family to maintain their standard of living, pay bills, and meet their financial needs.

5. Inheritance Planning:

Life insurance can be an effective tool for inheritance planning. It allows you to leave a tax-free sum to your heirs, ensuring that they receive their inheritance without the burden of inheritance tax.

6. Business Protection:

If you're a business owner or part of a partnership, life insurance can help secure the financial future of your business and protect your partners. It can be used to buy out a deceased partner's share, ensuring business continuity.

7. Peaceful Grieving:

Losing a loved one is emotionally challenging. Life insurance eases the financial stress during a difficult time, allowing your family to focus on grieving and healing without worrying about money.

Choosing the Right Life Insurance Policy:

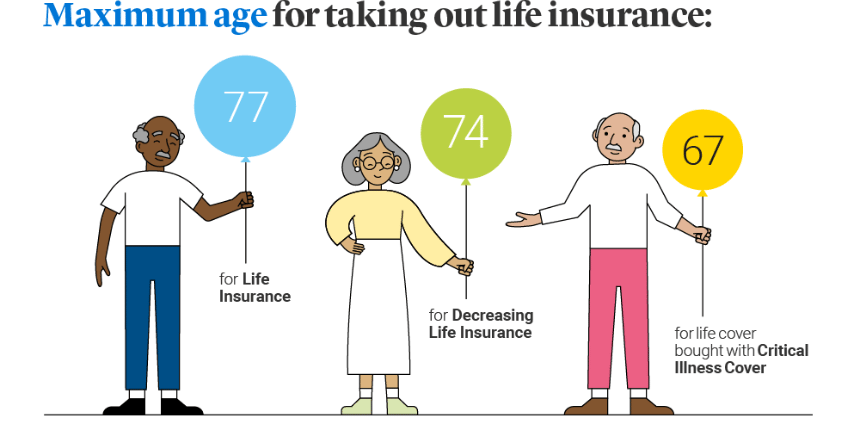

As a UK resident, you have several options when it comes to life insurance, including:

Provides coverage for a specific term, making it cost-effective. Ideal for covering specific financial responsibilities.

Offers lifelong coverage with a cash value component. It can be used as an investment tool and provides permanent protection.

Pays a lump sum if you're diagnosed with a critical illness, helping cover medical expenses and lifestyle changes.

Replaces a portion of your income if you're unable to work due to illness or injury.

Embracing Financial Security

Life insurance is not just about planning for the inevitable; it's about securing the future for those you care about most. As a UK resident, you have a wealth of options to choose from, allowing you to tailor your life insurance policy to your unique needs and financial goals.

By embracing life insurance, you're not just investing in financial security; you're investing in peace of mind. You're providing your loved ones with the support and protection they deserve, ensuring that your legacy lives on even after you're gone.

So, whether you're a young professional starting a family, a homeowner with a mortgage, or a business owner with responsibilities, consider the importance of life insurance for UK residents. It's a decision that reflects your commitment to your family's well-being and financial security today and tomorrow.

Need help in growing your business? If you care for your business and want to see it at the top like them, you can contact Grow Media Digital. Grow Media Digital is a one-stop solution for every digital need. For More Details, Visit Our Official Website: https://www.growmedia.digital/